In our conversations with banking execs, an usual style is exactly how the lending market is transforming and frequently giving rise to threats and chances, as covered in our Business Financial Top Trends for 2024 Confronting these adjustments is vital, yet it additionally requires banks to be willing to transform to stay in advance.

Formerly, we touched on three changes in loaning which covers being data-driven, embedded finance and incorporating ESG techniques In this last post, we cover the last calculated shifts: exactly how financial institutions can reconsider their borrowing product, service offerings and service designs to continue to be affordable.

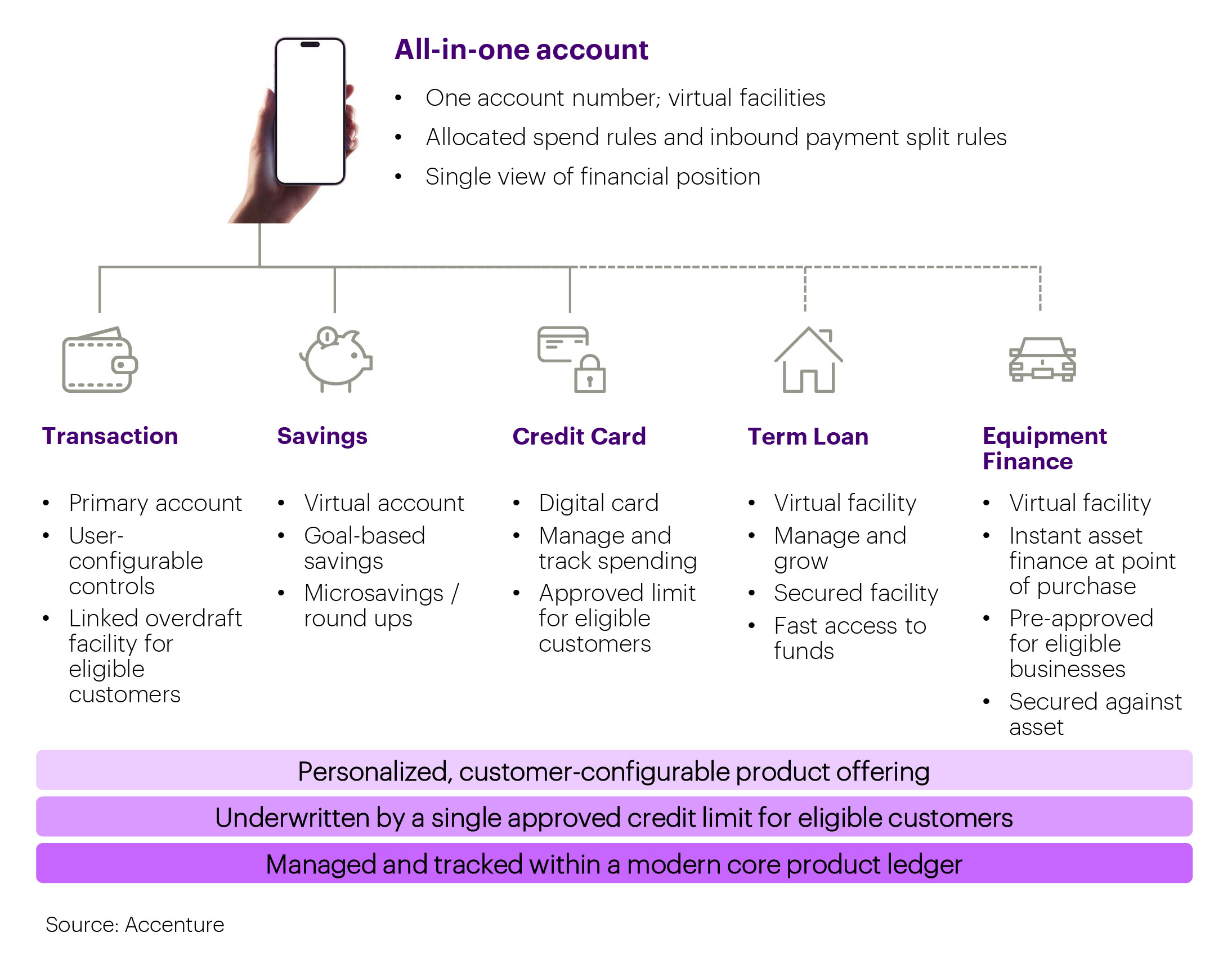

Change # 5: Reimagine product or services offerings, like the “all-in-one account”

Industrial banks must craft intuitive, end-to-end digital experiences to please consumers’ demands for a smooth financing procedure. Personalized proposals are vital, as a one-size-fits-all strategy falls short to resolve the diverse economic requirements of customers. Banks likewise need to streamline the onboarding of customers to numerous items to decrease duplication of processing, getting in touch with consumers and paperwork.

The “all-in-one account” is an example of a reimagined product offering that can cut through this complexity. Unlike the one-size-fits-all technique that uses the exact same item to every client, an “all-in-one account” offers an adaptable, comprehensive service customized to satisfy numerous private demands within a single account. It provides an unique proposal and progresses with the consumers altering needs. The one account number is an adaptable offering for virtual centers, establishes regulations for assigned spend and incoming settlement split and provides a single view of a client’s monetary setting.

Number 1: Features of an all-in-one account

An Asia Pacific bank presented an all-in-one countless card that works as a bank card, debit card and ATM card. It includes a prequalified “Always On” finance, budgeting tools, insights and tracking. This account makes handling funds easier for consumers and offers accessibility to working funding when required. It also permitted the financial institution to open up an account, concern a charge card and secure a lending in under five mins.

Change # 6: Transform the financing company design

New banking organization versions have actually moved from yesterday’s rigid vertically integrated and direct worth chain with “macro products” to today’s more common method of unbundling item parts.

As banks overcame their electronic change journey, numerous merely moved their existing value chain and service design to a digital format. However we are seeing a change from the typical up and down integrated versions to more adaptable and composable versions inspired by digital oppositions. Composable technology, for example, imitates a set of building blocks that you can blend and match in different ways to create various capacities.

In this model, financial institutions are deconstructing their operating design into micro-products or services, after that re-bundling these components with offerings from various other carriers to create customer-centric options. The ability to unbundle and re-bundle banking and financing items around clients is crucial to effectively address their diverse demands. The crucial differentiator in a globe of compressed margins and intense competition for financing and down payments, will certainly be the capacity to incorporate the right networks, products, processes and plan permutations for Micro, SME, Commercial and Corporate customers.

So currently what?

Lenders that focus on customer-centricity and take advantage of AI and advanced analytics for customization and split second decision-making are poised to lead the market. By highlighting joint ecological community partnerships, composable innovation and fragmented digital financial models, financial institutions can shift their emphasis from simply protecting market share to proactively going after genuine development.

To embark on this improvement, we recommend these actions:

-

- Determine which patterns will certainly have the largest impact on clients and the industry.

- Plan scenarios for the various feasible futures for the borrowing landscape.

- Settle on a “North Star” vision, priority segments and the hidden value proposal to drive competitive distinction.

- Specify what large business shifts are required for the future throughout item, procedure, policy, people and technology.

- Specify a portfolio of efforts, backed by concrete evidence of principle, to promptly show worth, develop energy and safe buy-in for bigger, extra critical funding demands.

If you would love to talk regarding any kind of element of this subject, please contact us– we ‘d welcome the chance to discuss your financial institution’s journey to the future of borrowing.

We wish to thank our colleague, Gustavo Pintado , for his contribution to this blog site collection.